The 9-Minute Rule for Clark Finance Group Mortgage Broker

Table of Contents4 Simple Techniques For Refinance Home LoanThe Best Guide To Home Loan LenderFacts About Home Loan Lender RevealedThe Only Guide for Clark Finance Group Refinance Home Loan

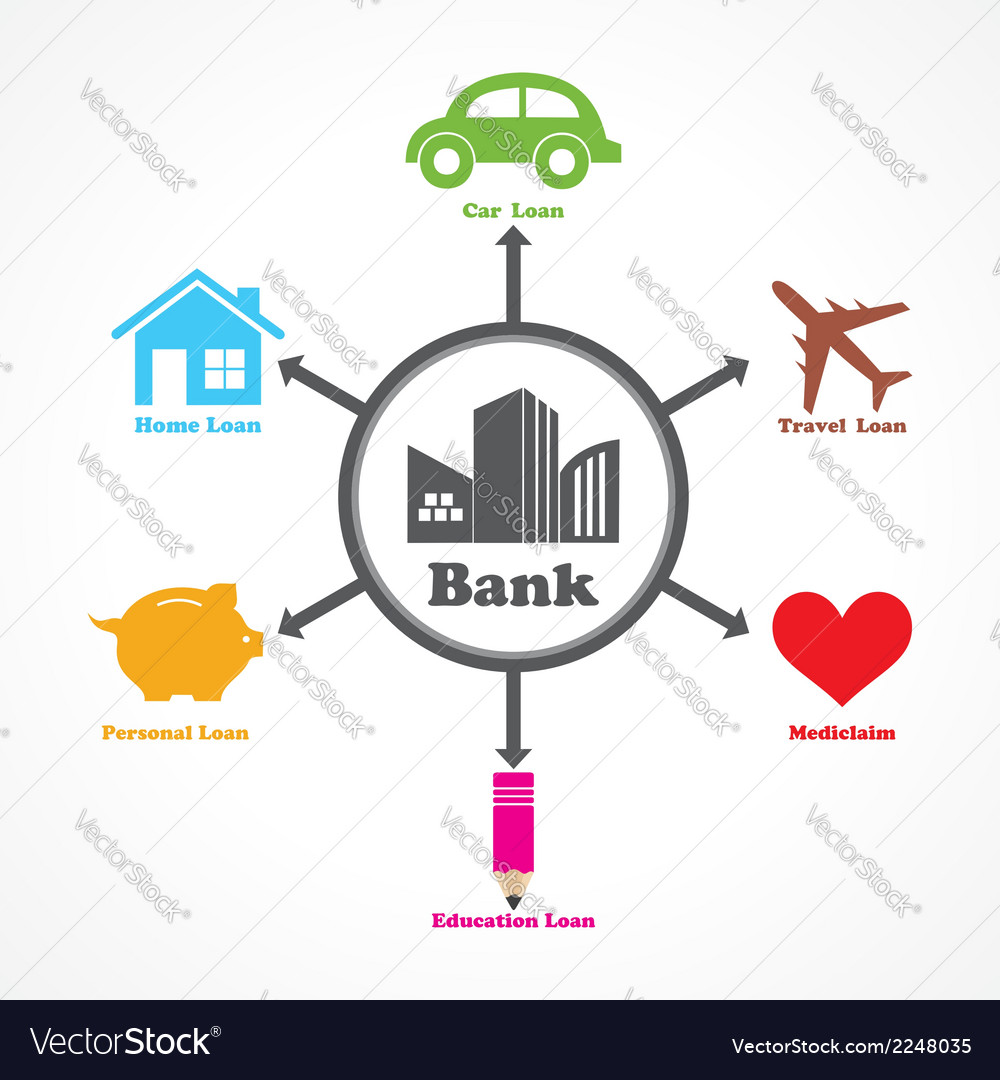

All financings aren't created equal. If you need to obtain cash, initially, you'll want to decide which kind of lending is right for your situation.

If you have high-interest bank card debt, a personal car loan might assist you settle that financial obligation quicker. To settle your financial debt with an individual funding, you 'd obtain a financing in the quantity you owe on your bank card. If you're authorized for the complete quantity, you would certainly use the finance funds to pay your credit history cards off, instead making month-to-month payments on your personal finance.

That's due to the fact that the loan provider may take into consideration a secured financing to be much less high-risk there's a possession supporting your loan. If you do not mind promising security and you're certain you can pay back your lending, a secured loan might help you conserve money on interest. When you utilize your collateral to get a finance, you risk of losing the property you used as security.

Mortgage Broker Things To Know Before You Get This

A pawn shop loan is another fast-cash borrowing alternative. You'll take a thing of value, like a piece of precious jewelry or an electronic, right into a pawn store and also obtain money based upon the thing's worth. Finance terms differ based on the pawn store, and interest prices can be high. Some states have tipped in to manage the market.

You might also get hit with costs and also additional prices for storage space, insurance policy or renewing your car loan term. Payday alternate funding amounts vary from $200 to $1,000, and also they have much longer settlement terms than payday finances one to six months rather of the typical few weeks you get with a cash advance lending.

A home equity lending is a kind of secured finance where your home is made use of as collateral to borrow a round figure of cash. The amount you can obtain is based upon the equity you have in your home, or the difference in between your home's market price and also exactly how much you owe on your house.

Given that you're using your house as security, your rates of interest with a home credit personal loan house equity financing may be reduced than with an unsecured personal finance. You can utilize your home equity finance for a variety of objectives, varying from residence improvements to medical expenses. Before getting a residence equity lending, make certain the payments are in your budget.

The Basic Principles Of Home Loan Calculator

She enjoys assisting individuals find means to much better handle their cash. Her work can be found on numerous websites, including Bankrate, Financing, Bu Find out more. Find out more.

Borrowed cash can be made use of for numerous functions, from funding a new service to buying your future husband an involvement ring. With all of the various types of finances out there, which is bestand for which objective? Below are her explanation the most typical kinds of finances as well as how they function. Secret Takeaways Personal loans and credit history cards feature high rates of interest but do not require collateral.

Cash loan usually have very high rate of interest plus deal costs. Personal Finances A lot of banks, online and also on Main Road, supply individual financings, as well as the proceeds may be utilized for virtually anything from purchasing a brand-new 4K 3D smart TV to paying bills. This is a costly method to get money, because the lending is unprotected, which suggests that the borrower does not set up collateral that can be seized in situation of default, just like an automobile financing or house mortgage.

The 3-Minute Rule for Clark Finance Group

Passion prices can be even more than three times that amount: Avant's APRs vary from 9 - Home Loan Lender. 95% to 35. 99%. The most effective prices can just be acquired by people with remarkable credit ratings and substantial possessions. The worst need to be withstood by people that have no other choice. A personal finance is most likely the very best way to choose those that need to obtain a reasonably small quantity of cash and are specific they can repay it within a couple of years.

If the customer stops working to fulfill the appropriate contractual commitment with the third event, that event can demand settlement from the bank.

A company may approve a specialist's proposal, for instance, on the condition that the service provider's bank problems a guarantee of settlement in case the professional defaults on the contract. An individual lending could be best for a person that requires to obtain a fairly little quantity of cash as well as ensures their capability to settle it within a number of years.